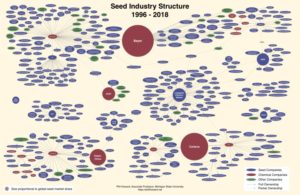

Philip H. Howard post on the Global Seed Industry Changes Since 2013 makes frightening reading. The assorted merges and amalgamation means that now the Big 4 companies now control 60% of the world’s seeds supply. The European Union’s recent changes on organic regulation, which now allows us organic producers to save and re use/ sell our own seeds, seen is this context is not exactly going to revolutionize the world, oh and by the way we have been doing it for years anyway.

Philip H. Howard writes

“Recent years have seen the “Big 6” agrochemical/seed firms combine into a Big 4:

- Dow and DuPont merged in a deal valued at $130 billion (announced in 2015), and then divided into three companies, including an agriculture-focused firm called Corteva

- Chemchina acquired Syngenta for $43 billion (announced in 2016)

- Bayer acquired Monsanto for $63 billion (announced in 2016)

- Bayer’s seed divisions (including the Stoneville, Nunhems, FiberMax, Credenz and InVigor brands) were sold to BASF for $7 billion to satisfy antitrust regulators (2018)

These four firms are now estimated to control over 60% of global proprietary seed sales. A number of the brands acquired in previous acquisitions have been retired.

Changes in the last five years also include dozens of acquisitions and joint ventures involving other top global seed firms, such as Limagrain’s Vilmorin-Mikado subsidiary (France), DLF (Denmark) and Longping High-Tech (China).

China now has two seed firms ranked in the top ten in global seed sales, ChemChina and Longping High-Tech. Since 2017, Longping High-Tech has acquired Dow’s maize division in Brazil, and controlling stakes in seven seed firms based in China. The firm is reportedly planning additional acquisitions in Argentina. After acquiring the Switzerland-headquartered firm Syngenta, ChemChina is planning more acquisitions in China.

The graphic below shows ownership changes occurring from 1996 to 2018. Note that the size of the largest circles are proportional to global seed sales, which are dominated by Bayer and Corteva.”

The full article with historical trends can be read here on Philip H. Howard web site Global Seed Industry Changes Since 2013