The French pig farming sector has undergone a massive transformation since the end of the Second World War. Pig farming has moved from its forest based pastural roots, through dirt yard production to a specialised indoor farming units more resemblance of an industrial factory than any idea of a farm. However the advent of the 21st century has seen the French pig industry falling behind both on a European and global level. This either represent the gradual death of a long history or French agriculture or a golden opportunity for a rebirth of a sustainable, diverse, and economically durable sector.

The French pig farming sector has undergone a massive transformation since the end of the Second World War. Pig farming has moved from its forest based pastural roots, through dirt yard production to a specialised indoor farming units more resemblance of an industrial factory than any idea of a farm. However the advent of the 21st century has seen the French pig industry falling behind both on a European and global level. This either represent the gradual death of a long history or French agriculture or a golden opportunity for a rebirth of a sustainable, diverse, and economically durable sector.

France saw it’s pig framing industry transformed in the late 20th century, global consumption of pork exploded and with it the size and productivity of production. The world at any one time now has around a billion pigs, this vast herd feeds the global world consumption of 110mmt (Million Metric Tonnes) of pork products every year.

Meat amount and % consumed in the world

| Meat | Meat consumed, 2012 (mmt) | Percentage of Meat (%) |

|---|---|---|

| Pork/Porcine | 110.8 | 37.4% |

| Poultry | 104.5 | 35.3% |

| Bovine | 66.8 | 22.6% |

| Ovine | 13.9 | 4.7% |

| Total common meats | 296.0 | 100.0% |

FAO; 2013. http://www.fao.org/docrep/012/ak341e/ak341e09.htm#TopOfPage.

The EU produced 21.9 mmt of pork in 2018, up 2.8% with respect to the same period in 2017 (+605,700 tonnes).The premier pork producer in the EU is Germany, with 4,9 million tonnes (-1.6%), followed by Spain, with 4.16 million tonnes (+6.7%), France (2.0 million tonnes, +0.6%), Poland (1.9 million tonnes, +5.2%) and Denmark (1.47 million tonnes, +6.9%). Eastern Europe countries have also seen large growth, such as Romania (+12%), Slovakia (+18%), Bulgaria (+11%) and Latvia (+9%). Source Eurostat.

Germany as Europe’s leader pales in comparison with China the world’s leading producer, approx 50 MMT and the US, approx 10 MMT.

Moving back to France the post war concentration of pig farms has been dramatic, in 1968 there were 795,000 farms with pigs as part of the overall produce, at the end of the first decade of the the 21st Century that had reduced to 15,000 the with around a third practising porcine monoculture. At the same time the total number of pigs raised has doubled. Free range pig production has been transformed into highly concentrated industrial protein units.

But this huge transformation has not enabled France to maintain it’s position in either the European market or the Global market. In 2000 France and Spain held joint second position in Europe at around 25.5 million pigs a year each, by 2016 French pig production had dropped to 21 million pigs whereas Spanish production had grown to 45 million. France is now a net importer of pork, the decline has been attributed to lack of investment and high costs, read labour costs. Source IB Research

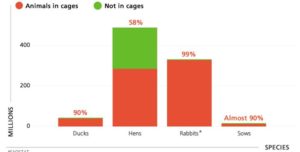

French pig farming, like the majority of European animal protein production moved heavily into caged production in the late 20th century. .It’s hay days were in the 1980s-90s.

I am not going to rehash the arguments around caged pig factories, the environmental, labour and health aspects, let alone animal welfare issues. If you need to know more details on the caged pig industry then the Compassion in World Farming reports are a good place to start. (Pig Welfare CIWF)

I am not going to rehash the arguments around caged pig factories, the environmental, labour and health aspects, let alone animal welfare issues. If you need to know more details on the caged pig industry then the Compassion in World Farming reports are a good place to start. (Pig Welfare CIWF)

French pig farming, as we have seen from the concentration of the number of pig farms and he hike in total number of pigs produced, followed the developed world path of moving from a free range to industrial model throughout the mid to late 20th century. However that French pig farming has deviated from their major European competitors over the last two decades.

Two major factors transformed the French pig farming sector, the first was the huge hike in food prices in 2008, and the second was the way the French government decided to translate the European Nitrate Directive into French law. Nitrate pollution from farming has a well documented history, particularly in Brittany ( See Killer Seaweed). The action taken by the French government effectively put a break on the further expansion in Brittany, the most important centre of French pig farming.

According to TB Research “the average size of a pig farm in France is between 1,000 and 2,000 pigs, as against Denmark and Holland, whose farms average 2,000 to 5,000 pigs. Moreover, between 2000 and 2010, the average size of a pig farm has grown by 98% in Denmark, by 37% in the Netherlands, by 29% in Spain and by only 16% in France.”

In a global market of standardised pork products smaller farms simply are competitive, and it is not just about size but also technology and investment. Smaller farms, that is pig farms with between 50 and 100 sows, fell by the wayside, a combination of aging farmers with no inheritors, and a lack of access to finance to either modernise or expand sealed their fate.

Despite this trend, in 2013 pig farms with 150 sows or less still represented 60% of the French pig industry.

Carole Bertin, a representative of the Regional Chamber of Agriculture in Brittany, where 70% of French pig farming is concentrated, conducted a study on the pig building status of 30 farrow-to-finish farms in Brittany in 2015. “They found that the average age of buildings was 22.1 years and above 20 years for all physiological stages (mating, gestating sows, farrowing rooms, nursery/post-weaning, finishing). ” Source PigProgress

There is of course a link between size and revenue in a market of standardised products revenue is totally dependent on quantity, not quality. Smaller production units simply cannot produce the quantity to provide the revenue for future investments and get caught in a perpetual downward cycle that eventually leads to acquisition or bankruptcy.

A brief look at Brittany pork prices year on year highlights the problem for French pig farming.

Annual pig prices (€/kg) in the Marché du Porc Breton,Plérin, France.

This market sets the price for pork for the whole of France. Source: French Pork & Pig Institute (IFIP)

| Year | Average price | Minimum price | Maximum price |

| 2012 | 1.454 | 1.229 | 1.736 |

| 2013 | 1.464 | 1.293 | 1.734 |

| 2014 | 1.327 | 1.111 | 1.537 |

| 2015 | 1.238 | 1.067 | 1.409 |

The average cost per kilo of pork production in France in 2015 was 1.55 euro per kilo.

If you cannot produce a product at a cost below the market price you haven’t got a business, just a big hole into which you either pour your own money or tax payers money in the form of CAP grants and aid.

The French pig farmer faces three choices, well four actually if you include suicide. Which sadly is the cause of a farmer’s death every three days in this country.

A move towards quality, a move towards quantity or a move out of the sector. Diversification and differentiation or a heavy investment low cost intensive production that is the two choices facing every farmer who wishes to continue farming pigs.

Of course it is not a real choice for most small scale farmers, access to affordable capital is limited. So an expansion into a high tech production model pumping out low cost meat is just not an option.

So what does diversification and differentiation mean?

European consumer trends in the 21st century are showing a strong move away from industrial produced meat, and, motivated by consumer concern of animal welfare, a stronger embrace of free range production in an overall domestic shrinking meat market. Strong product differentiation and regional, AOC, branding has a strong future in meat production and transformation French charcuturie retains a strong market position in the premium market both domestically and internationally. The example of French wine is often quoted, French wine with it’s strong cultural heritage has maintained a two fold price differentiation over it’s competitors on a global level.

Just after the Second World War France produced a wide range of rustic pigs, races adapted to regional conditions and feed supplies. Scientific advances, cross breeding for a higher yield and food to protein ratio lead to a concentration on four main varieties, Large white, Landrace français, Piétrain, Duroc. While some local varieties are still produced by small holders and upholders of local culture they represent a mere 0.2% of total French pig production.

As of a national order issued on the 27 Feb 2018, the French State “recognised” a strict list of pig varieties, that is varieties it is allowed to breed and sell.

- Recognised Racesː Créole de Guadeloupe (cochon Planche) ; Cul Noir Limousin (Porc de Saint-Yrieix, Périgourdin, Cul Noir, Limousin) ; Duroc ; Gascon (Gasconne) ; Landrace Français (Landrace) ; Large White ; Mei-Shan (Chinois) ; Nustrale (Corse) ; Pie Noir du Pays Basque (Basque, Bigourdan, Béarnais, Basco-Béarnais, Navarrin) ; Piétrain ; Porc Blanc de l’Ouest ; Porc de Bayeux.

- Local Racesː créole de Guadeloupe, Cul Noir Limousin, Gascon, Nustrale, Pie Noir du Pays Basque, Porc Blanc de l’Ouest, Porc de Bayeux.

- Races under threat of extinction. créole de Guadeloupe,, Nustral Pie Noir du Pays Basque, Porc Blanc de l’Ouest, Porc de Bayeux.

A return to quality and variety offers a huge unexplored opportunity to step off the productivist tread mill.

Free range, or to be more accurate less caged, production has already started to make inroads in pig, and indeed all animal production. Organic production, a whole new category of animal welfare has seen rapid growth amongst small and medium sized pig producers, albeit from a very low base. Less than 1,5% of all French pig farming is at present certified organic. 541 organic producers in 2018, a 23% year on year growth, but with only 49 other producers in conversion to organic the movement still lacks critical mass.

Free range, or to be more accurate less caged, production has already started to make inroads in pig, and indeed all animal production. Organic production, a whole new category of animal welfare has seen rapid growth amongst small and medium sized pig producers, albeit from a very low base. Less than 1,5% of all French pig farming is at present certified organic. 541 organic producers in 2018, a 23% year on year growth, but with only 49 other producers in conversion to organic the movement still lacks critical mass.

Further development of the organic and free range pig sector requires a speedier embrace of specialist infrastructure, particularly at the level of artisan transformation, and enhanced animal welfare infrastructure such as mobile abattoirs that minimise the transport of live animals.

There is still a long way to go but the crisis of French pig farming may also present a golden opportunity for a Renaissance and the creation of a diverse, sustainable industry.

Also see https://www.theguardian.com/environment/2019/nov/30/danish-bacon-what-happens-when-you-push-pigs-to-the-absolute-limit